Scallop Hits Record Revenue, Strengthens Leadership in DeFi Lending on Sui Ecosystem

Scallop, a lending and borrowing protocol on the Sui blockchain, has reported a record revenue of $79,920 in the past 24 hours alone, according to data from DeFiLlama. This achievement puts Scallop in second place among all DeFi lending protocols, behind only the long-established Aave. This underscores Scallop’s strong growth in the Sui ecosystem and the competition in the vast decentralized finance space.

Sui Ecosystem: A Launchpad for Innovation

Sui, a high-performance Layer 1 blockchain launched in May 2023, has quickly become the hub for scalable and efficient DeFi applications. With its unique object-centric data model and powered by the Move programming language, Sui offers low transaction fees, high throughput, and strong security. These features have attracted strong interest from the developer and user communities, pushing the total value locked (TVL) on the network to over $2 billion by early 2025, according to a report by DeFiLlama.

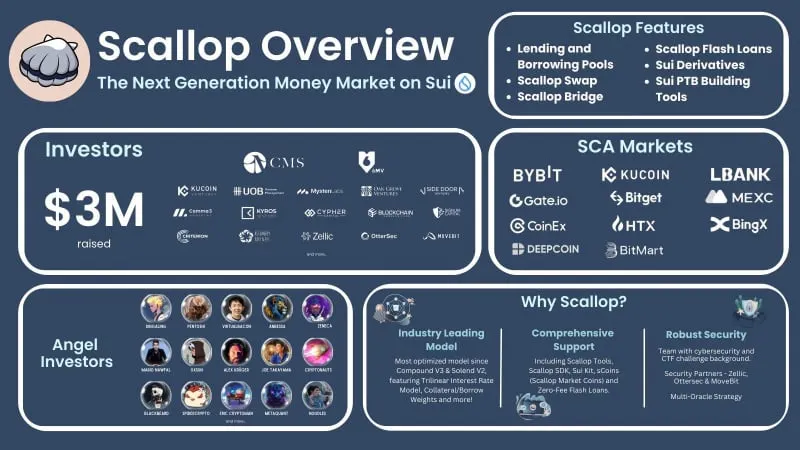

The Sui Foundation, the organization that drives the development of this blockchain, has played a key role in supporting innovative projects. Scallop was the first DeFi protocol to receive funding from the Sui Foundation, demonstrating its strategic importance in the ecosystem. With backing from well-known investment funds such as CMS Holdings, 6th Man Ventures (6MV), and support from prominent individuals such as Dingaling, Pentoshi, and Virtual Beacon, Scallop has a solid foundation for sustainable development.

Scallop: Redefining Lending on Sui

Scallop Lend is a peer-to-peer (P2P) money market protocol on Sui, providing a digital asset lending and borrowing platform with institutional-grade features. Since its token launch last year, Scallop has established itself as the leading lending protocol on Sui with a TVL of approximately $130.27 million as of March 29, 2025. This represents an impressive 34% growth in the past 7 days, reflecting trust and adoption from users. Scallop’s total collateral and deposits now stand at $187 million, with cumulative revenue reaching $3.94 million.

Scallop focuses on security, ease of use, and user experience. The protocol separates lending assets from collateral assets to optimize resilience, while using a voting margin (tick) model to incentivize borrowing. Users can lock up Scallop’s native token $SCA to receive higher yield rewards. To date, over 27 million $SCA tokens, equivalent to 10% of the total supply, have been locked by the community for an average of 3.72 years, demonstrating a strong commitment to the protocol.

In recent days, Scallop has expanded its offerings by listing the Walrus token and partnering with Binance Wallet to launch a yield-focused operation. These moves demonstrate Scallop’s continued efforts to diversify its ecosystem and bring value to its users.

Fierce Competition in the DeFi Lending Space

With $79,920 in 24-hour volume, Scallop is becoming a formidable competitor in the DeFi lending space, second only to Aave – a protocol with a long-standing presence on Ethereum and many other blockchains. Leveraging Sui’s technical advantages, Scallop provides a seamless experience for both borrowers and lenders, while also providing an open-source framework that allows other projects in the Sui ecosystem to build on its infrastructure.

As the Sui ecosystem continues to grow, Scallop’s performance shows that it is ready to maintain its leadership position in the DeFi lending space. The protocol’s strategic partnerships, community engagement, and strong metrics underscore its potential to shape the future of DeFi on Sui and beyond.

About Scallop

Scallop is a next-generation peer-to-peer money market pioneered for the Sui ecosystem and the first DeFi protocol to receive official funding from the Sui Foundation.

Scallop offers a wide range of financial services, including high-interest lending, low-fee borrowing, asset management, and automated market making (AMM) tools, all available on a single platform. Furthermore, Scallop provides a software development kit (SDK) that enables professional traders to execute complex trades with ease, including zero-interest loans. With a focus on security and compliance with best practices, Scallop aims to reduce risk in the DeFi space, providing a trustworthy platform for users.